This article will talk about how to calculate the trend or effect of future value changes for different compounding periods in a Microsoft Excel spreadsheet or Google Sheets via a formula.

Table of Contents

What is the period of compound interest?

The compounding period is the time interval at which the bank calculates the interest rate on unpaid cash and usually corresponds to the payment period, but not necessarily so.

The payment period is the time interval over which payments are made. The size of the periodic payments on a given loan is related to the interest rate and the length of the loan term. The longer it takes the borrower to pay off the loan, the more interest he/she will pay to the bank. In addition, the more often a borrower makes annual payments to the bank to reduce the outstanding balance (e.g., monthly rather than annually), the less interest he/she will have to pay over the entire repayment period. When the borrower and lender agree on the loan amount, interest rate and loan term, it is easy to calculate the amount to be repaid in each installment.

What is FV?

Future value (FV), also known as future value, is the value of a certain amount of money at some point in the future. It is usually recorded as FV.

Example: The ultimate value of simple interest formula.

- FV: Future value;

- PV: Present value;

- Rate: Interest rate (discount rate);

- Periods: The number of periods for calculating interest

Calculation of the future value

The formula for calculating the future value of simple interest is as follows:

FV = PV * (1 + n * i)

The formula for compound interest future value is as follows:

FV=PV * (1 + i)n

General Formulas in Excel / Google Sheets

You can use the following general formula in Excel or Google Sheets to calculate the future value of an investment based on a constant interest rate, as follows

=FV(rate,nper,pmt,[pv],[type])

The syntax of the FV function has the following parameters.

- Rate – This is a mandatory parameter, which is the interest rate per period.

- Nper – This is a mandatory parameter, the total number of annuity payment periods.

- Pmt – This is a mandatory parameter, the amount of each payment; it cannot be changed during the lifetime of the annuity. Normally, pmt includes the principal and interest, but not other fees or taxes. If pmt is omitted, the pv parameter must be included.

- Pv – This is an optional parameter, final or future value. If pv is omitted, it is assumed to be 0 (zero) and you must include the pmt parameter.

- Type – This is an optional parameter with a number of 0 or 1, indicating the time of payment. If type is omitted, it is assumed to be 0.

Example

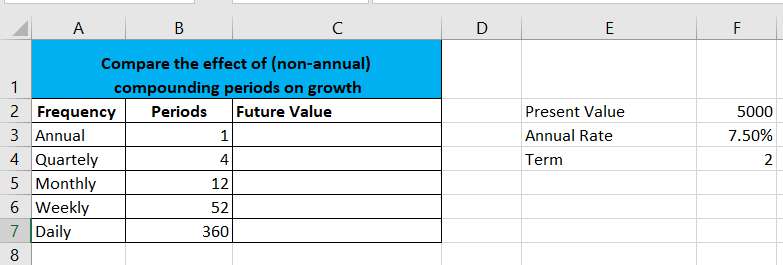

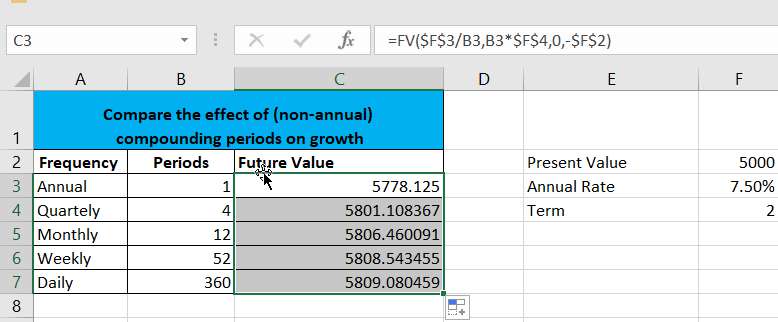

For the worksheet shown above, we can use the FV function to calculate the future values for different compounding periods so that we can clearly see the impact of compounding periods on growth. Through the data table, we can see that the initial value is 5000, its annual investment rate is 7.5%, the Periods column is the different compounding periods, and then we can calculate the future value PV of 5000 by using the FV function, you can enter the following formula in cell C3 of the Excel or google worksheet.

=FV(F3/B3,B3*F4,0,-F2)

Formula explanation

Let’s explain how the above general formula works. The FV formula is used in Microsoft Excel or Google Sheets to calculate compound interest and return the future value of an investment over a specified period. To use this formula, then you need to provide some necessary parameters, such as: interest rate, number of periods, present value, etc.

For the above example.

Present value is cell F3.

The interest rate is determined by dividing the annual interest rate value by the number of periods, i.e. F3/B3

The number of compounding periods is the value of the terms multiplied by the number of periods, i.e. F4*B3

With these parameter values above, we can calculate the future value of the different periods.

Q&A

1. How do I calculate compound interest in Excel with different rates?

A more efficient way to calculate compound interest in Excel is to apply the general interest formula: FV=PV(1+r)n, where FV is the future value, PV is the present value, r is the interest rate per period, and n is the number of periods of compound interest.

2. What will be the effect if the compounding period is increased?

Increasing the number of compounding periods increases the effective annual interest rate compared to the nominal rate.

3. Which is better compounded monthly or annually?

Due to compounding, the annual interest rate is usually a higher rate. Instead of monthly payments, the amount invested has a 12-month increase. However, if you can get the same interest rate for monthly payments as for annual payments, then take it.