This post will guide you how to use Excel VDB function with syntax and examples in Microsoft excel.

Table of Contents

Description

The Excel VDB function calculates the depreciation of an asset for a specified period based on the double declining balance method. And it will return a numeric value.

The VDB function is a build-in function in Microsoft Excel and it is categorized as a Financial Function.

The VDB function is available in Excel 2016, Excel 2013, Excel 2010, Excel 2007, Excel 2011 for Mac.

Syntax

The syntax of the VDB function is as below:

= VDB (cost, salvage, life, start_period, end_period, [factor], [no_switch])

Where the VDB function arguments are:

- Cost -This is a required argument. The initial cost of the asset.

- Salvage -This is a required argument. The value of the asset at the end of the depreciation.

- Life -This is a required argument. The number of periods over which the asset is to be depreciated.

- Start_period -This is a required argument. The starting period for which you want to calculate the depreciation.

- End_period -This is a required argument. The ending period for which you want to calculate the depreication.

- Factor -This is an optional argument. It is specified the rate of depreciation.

- No_switch -This is a required argument. A logical value specifying whether to switch to straight-line depreciation when depreciation is greater than the declining balance calculation. And it can be either a value of TRUE or FALSE.

| TRUE | Using declining balance method of depreciation. |

| FALSE | Using the straight-line depreciation method when the straight-line depreciation is greater than the declining balance depreciation amount. |

Excel VDB Function Examples

The below examples will show you how to use Excel VDB Function to calculate the straight line depreciation of an asset for one period.

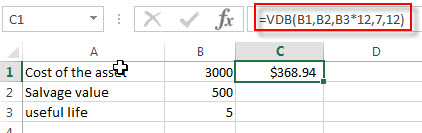

#1 to get the depreciation between the 7th and 12th month for an asset that cost 3000, with a salvage value of 500, and the useful life of the asset is 5, using the following formula:

=VDB(B1,B2,B3*12,7,12)

Related Functions

- Excel SLN Function

The Excel SLN function calculates the depreciation of an asset for one period based on the straight line depreciation. And it will return a numeric value.The syntax of the SLN function is as below:= SLN (cost, salvage, life)… - Excel SYD Function

The Excel SYD function calculates the sum-of-years’digits depreciation of an asset for a specified period. And it will return a numeric value.The syntax of the SYD function is as below:=SYD(cost, salvage, life, per)…

Leave a Reply

You must be logged in to post a comment.